Crypto Market Making Software is a powerful tool that helps to create liquid markets for digital assets on decentralized trading platforms. This type of software is typically employed by cryptocurrency exchanges to draw buyers to their platform. A good crypto market making software program should offer features such as back testing, risk management modules, a user friendly interface, and many other perks. Choosing a good one is crucial for making sure that you get the most out of your crypto investment.

Table of Contents

Best Crypto Market Making Software & Services: Country-Wise Breakdown

| Country / Region | Software / Service Name | Key Features / Focus | Type | Best For |

| Global / Multi-National | Hummingbot | Scriptable strategies, DEX/CEX connectors, GUI & code-based | Open-Source Framework | Developers, teams building custom MM bots |

| UK | B2C2 | Pioneering OTC electronic market maker, crypto and FX | Managed Service & Liquidity Provision | Institutions, corporate treasuries |

| Singapore / APAC | Amber Group | Full-service digital asset platform, portfolio management + MM | Managed Service & Asset Management | APAC projects, high-net-worth clients |

| USA | Wintermute | High-frequency, algorithmic OTC, deep liquidity across assets | Managed Service & Proprietary Tech | Large-cap tokens, DeFi protocols, institutions |

| Switzerland / EU | Keyrock | Adaptive algorithms, regulatory focus (MiFID II), market integrity | Managed Service & SaaS | EU-based projects, regulated entities |

| Global (HQ: Singapore) | Woorton (Groupe Genius) | OTC focus, licensed (PSAN in France), algorithmic execution | Managed Service & Proprietary Tech | Projects seeking EU regulatory compliance |

| Hong Kong | Auros (fka B2C2 Japan) | 24/7 HFT, focus on derivatives and perpetual swaps | Managed Service & Proprietary Tech | Derivatives-heavy projects, institutional flow |

| Global | ALPACA (YC W19) | Algorithmic trading API, brokerage integration, educational focus | Self-Serve Platform & API | Retail traders, algo trading developers |

| Netherlands | Flow Traders | ETF and digital assets MM, strong balance sheet, regulated | Managed Service (Publicly Listed) | Large, publicly-traded token projects |

| Japan | Liquid (formerly Quoine) | Integrated with Liquid exchange, strong APAC compliance | Exchange-Integrated MM | Projects listing on Liquid exchange, APAC focus |

| Global | Kaiko Tardis Engine | Historical data + execution simulation, strategy development | Backtesting & Simulation | Quant teams testing strategies pre-deployment |

| USA | GSR Markets | Tier-1 liquidity, OTC, derivatives, token issuance support | Managed Service & Proprietary Tech | Large token projects, institutions |

| Global / Multi-National | CoinRoutes | Smart order routing, algorithmic execution across 80+ venues | Institutional Software | Hedge funds, asset managers, OTC desks |

| Global | Kronos Research | HFT, quantitative research, provides liquidity to other venues | Proprietary Tech & Liquidity Provision | Exchanges needing liquidity, institutional partners |

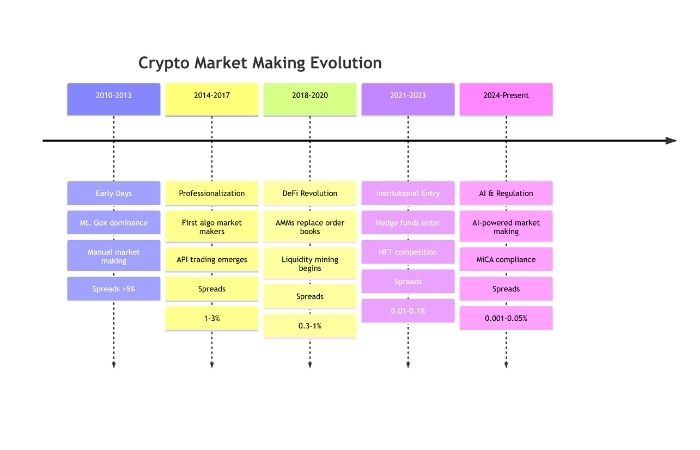

History Of Crypto Market Making

Active Market Makers & Service Providers in India

| Company Name | Primary Model | Key Details / Focus | Target Clients | Regulatory Status |

| CoinSwitch Ventures / Web3 | Managed Service (via partnerships) | Part of CoinSwitch Kuber ecosystem, provides liquidity solutions for listed tokens | Indian crypto projects, exchanges | Registered with FIU-IND, compliant with local regulations |

| BuyUcoin Market Making | Exchange-Managed | Provides liquidity support for tokens listing on their platform | Projects listing on BuyUcoin | FIU-IND registered |

| Unocoin Market Support | Managed Service | Focuses on Bitcoin/ETH liquidity with some altcoin support | Conservative projects, BTC/ETH pairs | FIU-IND registered |

| WazirX Market Maker Program | Exchange-Managed | Official program for WRX & selected tokens on WazirX exchange | Projects listing on WazirX | FIU-IND registered, under Binance umbrella |

| Giottus Liquidity Solutions | Managed Service | Chennai-based exchange offering market making for listed assets | South Indian crypto projects, SMEs | FIU-IND registered |

| CoinDCX Pro Services | Managed Service | Through their institutional arm, provides OTC and liquidity solutions | High-net-worth clients, institutions | FIU-IND registered, Singapore entity |

| ZebPay Liquidity Partners | Managed Service | One of India’s oldest exchanges with institutional MM services | Established tokens, corporate clients | FIU-IND registered, MAS Singapore licensed |

International Market Makers Serving Indian Clients

| Company | Service to India | Key Considerations |

| Wintermute | Active with Indian exchanges (WazirX integration) | Global liquidity, uses INR pairs, substantial volume |

| Amber Group | Serves Indian institutions and HNWIs | Portfolio management + market making combo |

| GSR Markets | Serves Indian token projects globally | Prefers projects with global ambitions, not INR-focused |

| Keyrock | Provides liquidity to Indian exchanges remotely | Strong tech, but primarily USD/stablecoin pairs |

Types & Features

| Software Type | Primary Users | Cost Range | Best For | Key Features |

| SaaS Solutions | Professional traders, Funds | $500-$5K/month | Growing funds, teams | Cloud-based, backtesting, API access |

| Broker-Integrated | Beginners, Retail traders | Free-$300 per month | small capital, Beginners | limited customization, User-friendly |

| Open-Source | Developers, Startups | $0 (hosting costs) | Technical teams, testing | Customizable, free, community support |

| Enterprise Platforms | Exchanges, Institutions | $10K-$100K/month | exchanges, Large funds | OMS integration, AI-driven pricing, multi-exchange |

Top Software Solutions (2025)

Enterprise Grade:

- CoinRoutes – Smart order routing across 90+ exchanges

- AlgoTrader – Institutional platform with custody integration

- Trading Technologies – Professional trading infrastructure

Professional Tier:

- Hummingbot (Open-source + Enterprise) – Popular DEX/CEX market making

- 3Commas – Retail-focused with market making bots

- Quadency – Multi-exchange portfolio with MM strategies

DEX Specialized:

- Uniswap V3 Liquidity Management Tools

- Gamma Strategies – Concentrated liquidity management

- Charm Finance – Options market making

Exchange Methods Comparison

| Method | Speed | Fees | Privacy | Best For |

| CEX (Centralized) | Seconds | 0.1%-0.5% | Low (KYC) | Beginners, large trades |

| DEX (Decentralized) | 1-5 minutes | 0.3%-1% + gas | High | Privacy, smaller trades |

| P2P Platforms | 5-30 minutes | 1-5% | Medium | Local currency, unbanked |

| OTC Desks | Minutes | 0.1-0.3% | Medium | Institutions (>$50K) |

| Atomic Swaps | 2-10 minutes | Network fees only | High | Cross-chain, no KYC |

Strategic Locations for Market Makers |

|||

| Location | Advantages | Disadvantages | Major Players |

| USA (Miami) | Growing hub, talent pool | lawsuits, Strict regulations | FTX (former), Blockchain.com |

| UK/London | timezone, Financial expertise, | Regulatory uncertainty, taxes | CoinShares, B2C2 |

| Singapore | Crypto-friendly, Asian hub, low tax | limited local market, High competition | Amber Group, Matrixport |

| Switzerland (Zug) | Regulatory clarity, banking access | High costs, European focus | Bitcoin Suisse, Sygnum |