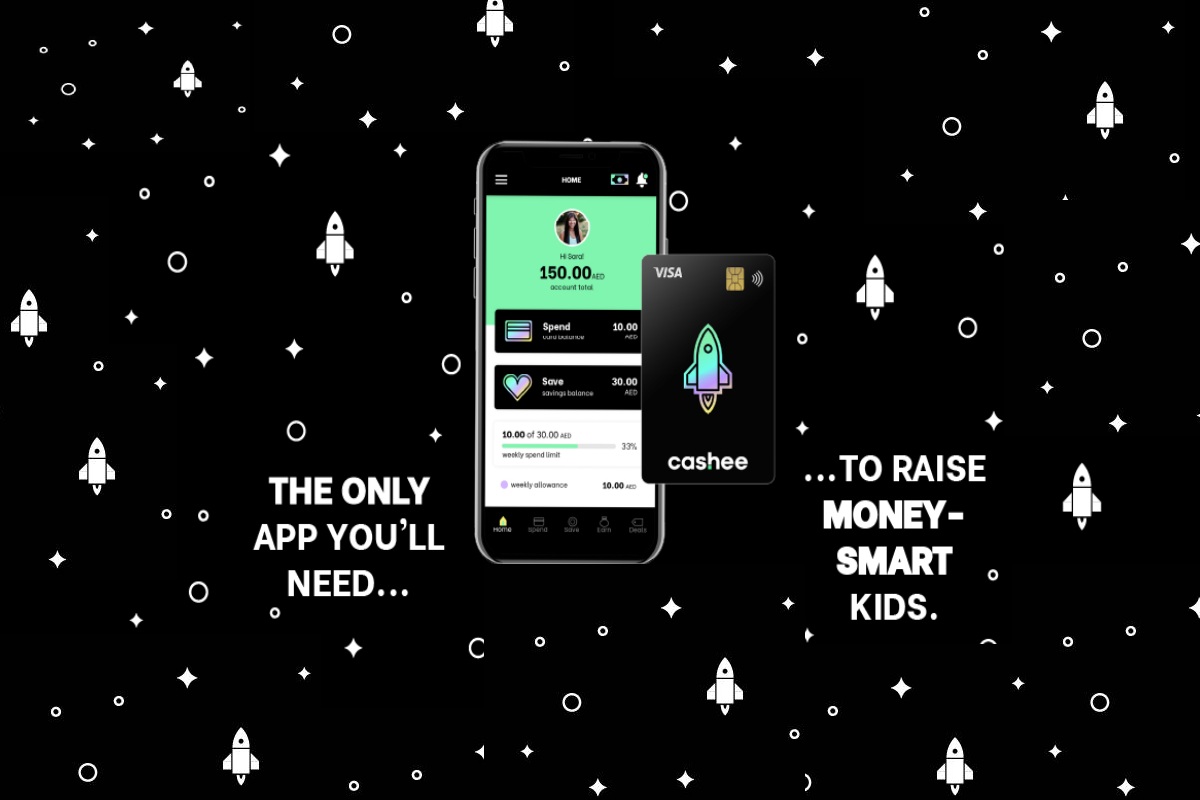

Cashee Tech FZE is a technology provider and offers a Visa prepaid card and banking application for teens in the UAE. We aim to improve financial literacy levels among the youth and thus provide teens aged 13 years and above with their digital banking platform and VISA card. Cashee cards remain issued by Magnanti, a subsidiary of First Abu Dhabi Bank, according to license by VISA International.

We take safety very seriously and operate by maintaining strict compliance with all the guidelines, requirements, directives and conditions issued by the Central Bank of the UAE and First Abu Dhabi Bank. All funds will always be held securely with First Abu Dhabi Bank. We also take additional measures to evaluate the risk across all our platforms and have constant backup and firewalls in place to keep your data safe at all times.

Cashee offers a digital banking platform and also VISA card for teens 13 years and above… and it’s FREE.

Table of Contents

Cashee is Leaders in Fintech 2021 Winner

The Cashee UAE leads the OECD Global Money Week initiative in the UAE for 2022.

Cashee, a teen banking platform for the MENA region, has been accepted by the OECD to represent the UAE in the Global Money Week.

Global Money Week

Global Money Week is an international awareness-raising campaign to ensure that young people are financially aware and gradually acquire the knowledge, skills, attitudes, and behaviours to make sound financial decisions.

Digital Banking Platforms

- Children as young as age eight can open a digital bank account in the UAE for the first time.

- Many clients want to bank anywhere, anytime on whatever device. And do it in a seamless and cost-effective, if not free, way.

- Digital banks have a tech advantage, which results in a lower cost of serving clients.

- Opening and maintaining a bank account for kids pose some challenges for parents.

VISA card Designed for Teens

100% Save

Get a card that uses state of the art chip security and 256-bit encryption—issued by Partner Bank.

Personalized Visa Card

Pick a design and also get your personalized card. Use the card online or offline whenever Visa remains accepted.

Digital Money Management

Develop the convenience and good habit of tracking your earnings, savings and spending at your fingertips. Start early and finish first.

How to Join the Cashee

Register for Free

Download the app and make your account within minutes with your Emirates ID.

Ask your Parent

Show the cashee link with your parents and get them to complete the registration process.

Get your Cashee card

Then get your cashee Visa card or Debit card for teens within three business days and start earning, saving and spending instantly.

FAQ of Cashee

Is Cashee a Bank?

Cashee is a technology provider and not a bank. A partner bank helps them meet all its banking requirements and also licenses to operate in the United Arab Emirates.

What ages can apply for a Cashee card?

It is available for teens and also adolescents from 13yrs – 21yrs of age. Users must have a vaid Emirates ID to register.

What is a Teen Account?

A teen account is for users between 13 – 21yrs of age and also holding a valid UAE Emirates ID. Teen accounts are separate from parent accounts and also, for all practical purposes, work as independent savings, earnings and spending accounts.